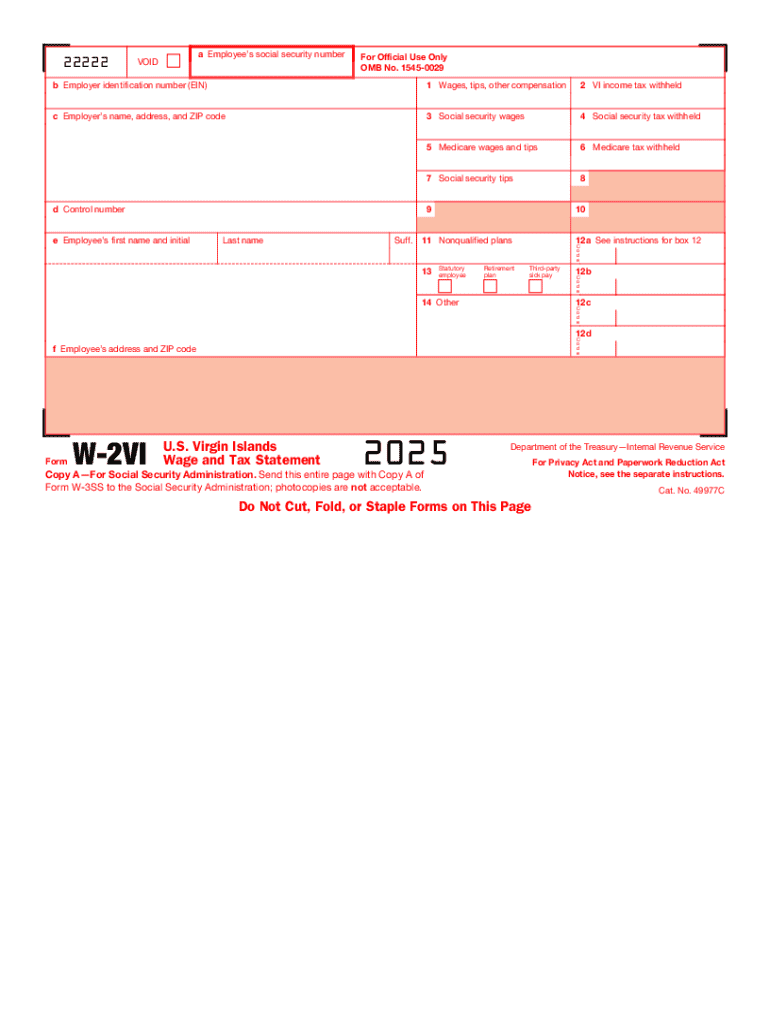

IRS W-2VI 2025-2026 free printable template

Instructions and Help about IRS W-2VI

How to edit IRS W-2VI

How to fill out IRS W-2VI

Latest updates to IRS W-2VI

All You Need to Know About IRS W-2VI

What is IRS W-2VI?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS W-2VI

What should I do if I realize I've made an error on my submitted IRS W-2VI?

If you discover a mistake after filing your IRS W-2VI, you must file a corrected form. This involves completing a new W-2VI with the correct information and marking it as a correction. Ensure to send it to the appropriate recipients promptly to avoid potential penalties.

How can I track the status of my IRS W-2VI after submission?

To verify the receipt or processing status of your IRS W-2VI, you can use the IRS's online tools or contact their support for assistance. Keep an eye out for any notifications regarding e-file rejection codes to address any issues swiftly.

What are some common errors to avoid when filing the IRS W-2VI?

Common errors when filing the IRS W-2VI include incorrect taxpayer identification numbers or mismatched names. Ensure all data is accurate and double-check for typographical mistakes to minimize the risk of rejection and the need for corrections.

Are there any specific technical requirements for e-filing the IRS W-2VI?

When e-filing the IRS W-2VI, ensure your software meets IRS compatibility standards and is updated for the current tax year. You may also need a secure internet connection and compatible browsers to ensure a smooth submission process.