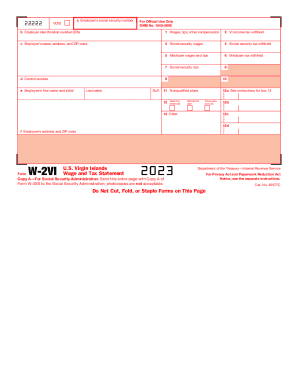

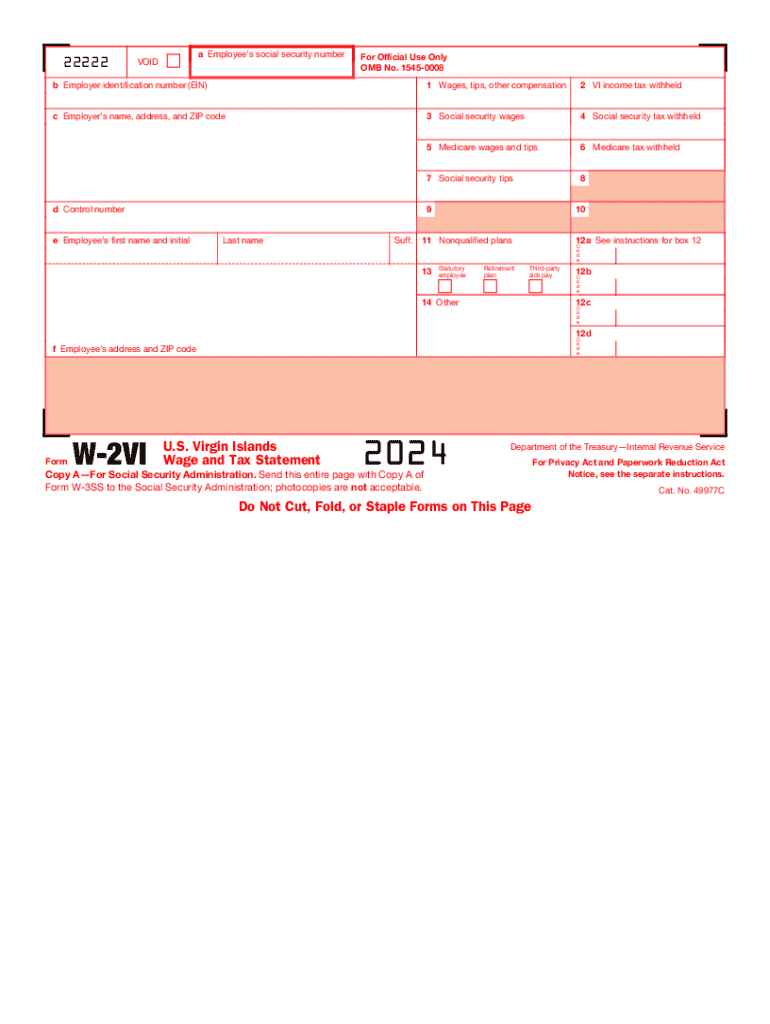

IRS W-2VI 2024-2025 free printable template

FAQ about IRS W-2VI

What should I do if I discover an error on my already submitted IRS W-2VI?

If you find a mistake on your submitted IRS W-2VI, you should file a corrected form as soon as possible. To do this, prepare a new IRS W-2VI with the correct information and note that it is a correction. Make sure to indicate the specific error that occurred to avoid confusion during processing.

How can I verify that my IRS W-2VI has been received and processed?

To check the status of your IRS W-2VI, you can contact the IRS directly or use their e-file tracking system, if applicable. It's important to retain any confirmation receipts you received during submission to assist in your inquiry.

What are some common issues that might lead to rejection of an IRS W-2VI e-filing?

Common issues leading to e-filing rejection include incorrect taxpayer identification numbers, mismatched names, or formatting errors. It's advisable to double-check all entries against IRS guidelines to minimize these risks before submission.

Are electronic signatures acceptable for IRS W-2VI submissions?

Yes, electronic signatures are acceptable for IRS W-2VI submissions, provided that the e-filing service used complies with IRS standards for electronic signatures. Ensure you retain necessary documentation to validate the authenticity of the e-signature used.

What should I do if I receive a notice or letter from the IRS regarding my IRS W-2VI?

If you receive a notice or letter from the IRS about your IRS W-2VI, promptly review the document to understand the issue. Prepare any related documentation and respond within the specified timeframe, detailing how you intend to address the IRS's concerns.